You’re on the right track. The Harvard Business Review reports that most startups become successful because of the vision of the founder(s) and core team. Now that you have the vision, you’ll need to figure out a business plan to raise capital. Here’s the thing: raising capital is usually a difficult process that requires persistence and hard work. Here’s how you can finance your startup in a few steps:

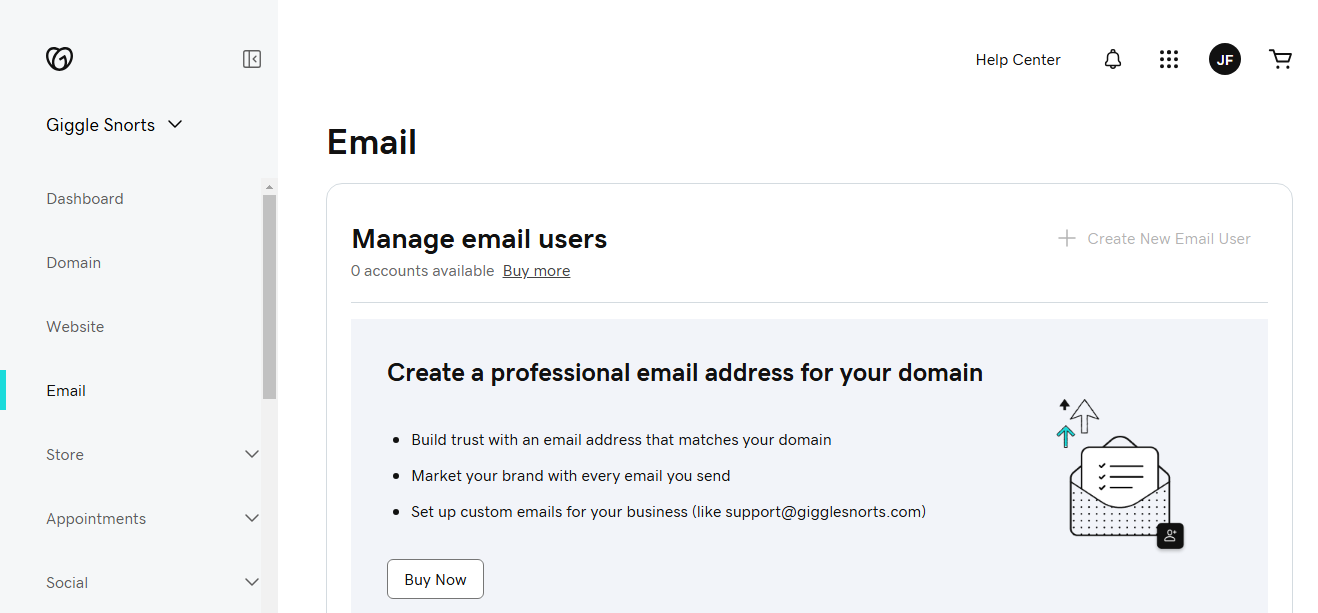

- Craft a Business Plan

Do you have a business plan? If you don’t, this should be your first step before looking to get your startup financed. Potential investors want to know what they’re investing in before giving you the startup capital you need to launch this thing.

- Ask Family and Friends

It can feel embarrassing or awkward to ask family or friends for money. Instead of approaching the situation like you are borrowing money, you should approach it like you’re sharing your amazing business plan and startup idea. If you make your family and friends feel invested in your startup, there’s much more of a likelihood that they will help finance your company.

- Bank Loans

If you don’t have any luck with getting capital from family, friends, or business partners — you could always take out a bank loan. I’d recommend this financing method as a last-ditch effort to get financing for your startup. Bank loans are sometimes necessary (please be sure to shop around for the lowest interest rates possible).