In the world of investing, there’s a powerful strategy that has captured the attention of investors seeking to capitalize on the upward trajectory of stocks—momentum investing. Momentum investing is based on the principle that stocks that have been performing well in the recent past are likely to continue performing well in the near future. In this comprehensive guide, we will explore the concept of momentum investing, its underlying principles, and how you can leverage this strategy to profit from stocks on the rise.

Section 1: Understanding Momentum Investing

Before delving into the details of momentum investing, it’s essential to grasp the fundamental concept behind this strategy.

1.1 Definition of Momentum Investing: Momentum investing is an investment strategy that focuses on buying stocks that have exhibited strong relative performance in the recent past. This strategy assumes that assets that have been rising in price will continue to do so, and assets that have been falling will continue to decline.

1.2 Contrast with Value Investing: Unlike value investing, which seeks undervalued stocks, momentum investing doesn’t necessarily look for stocks that are trading below their intrinsic value. Instead, it concentrates on stocks with strong recent price performance.

Section 2: The Principles of Momentum Investing

To effectively utilize momentum investing, it’s essential to understand the principles that underpin this strategy.

2.1 Price Momentum: The core principle of momentum investing is the belief that stocks that have exhibited price momentum in the past (typically over the last 6 to 12 months) are likely to continue their upward trajectory. This is often attributed to the psychological phenomenon of investor herding behavior.

2.2 Relative Strength: Momentum investors often use relative strength indicators to identify strong-performing stocks compared to a benchmark, such as an index. Relative strength is a key metric in this strategy.

2.3 Trend Following: Momentum investors are essentially trend followers. They believe that trends persist, and they aim to capitalize on the continuation of existing trends, whether they are upward or downward.

Section 3: Identifying Momentum Stocks

Now that we have a solid foundation of the principles of momentum investing, let’s explore how to identify stocks with strong momentum.

3.1 Price Charts and Technical Analysis: Investors often use price charts and technical analysis tools to identify stocks on the rise. Common technical indicators include moving averages, the Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence).

3.2 Relative Strength Analysis: Relative strength analysis involves comparing a stock’s performance to a benchmark index. Stocks that consistently outperform the benchmark are considered strong momentum candidates.

3.3 Fundamental Analysis: While momentum investing primarily focuses on price movements, some investors incorporate fundamental analysis to validate their stock selections. Strong financials and growth prospects can further support the case for a momentum stock.

Section 4: Risks and Challenges of Momentum Investing

While momentum investing has its advantages, it’s essential to be aware of the risks and challenges associated with this strategy.

4.1 Volatility: Momentum stocks can be volatile, and their prices may experience sharp fluctuations, making it crucial for investors to have a risk management strategy in place.

4.2 Reversals: Momentum investing relies on trends continuing, but there’s always the risk of a trend reversal. Stocks that were once in favor may fall out of favor suddenly.

4.3 Market Timing: Successfully timing the market and entering and exiting momentum stocks at the right time can be challenging, and mistimed trades can lead to losses.

4.4 Overvaluation: Some momentum stocks may become overvalued, and investors need to distinguish between healthy momentum and speculative bubbles.

Section 5: Leveraging Momentum Investing Strategies

To leverage momentum investing effectively, investors can follow these steps:

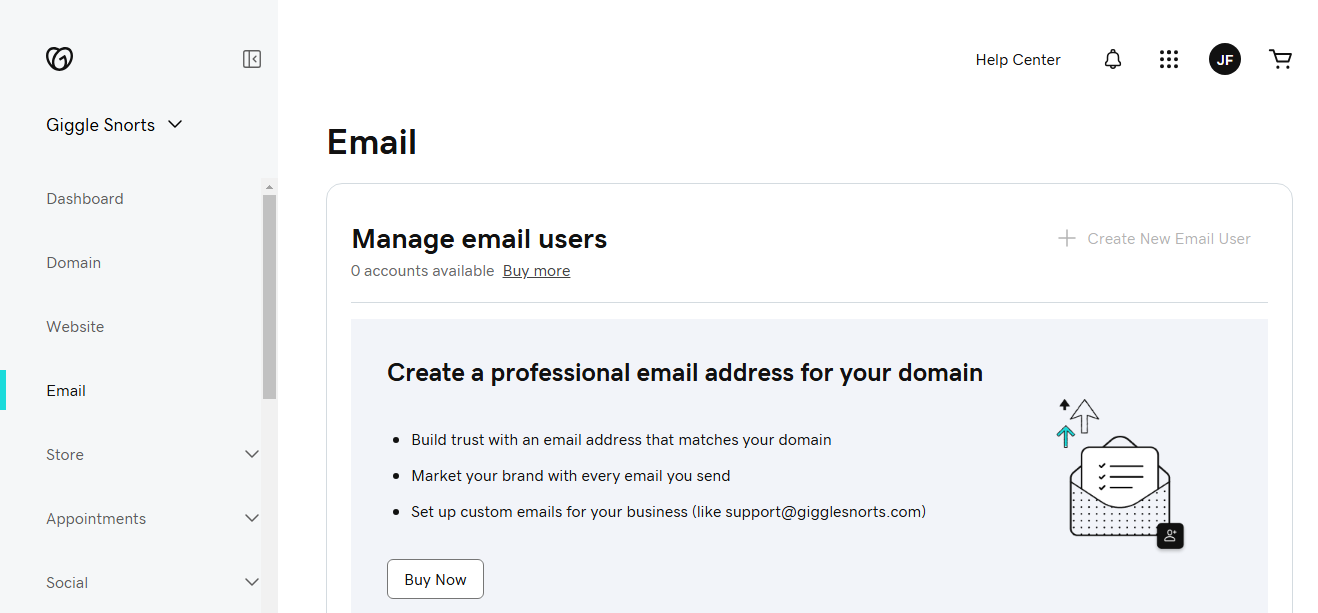

5.1 Identify Strong Momentum Stocks: Use technical and fundamental analysis to identify stocks with strong price momentum and relative strength.

5.2 Diversify Your Portfolio: While focusing on momentum stocks, ensure a diversified portfolio to spread risk.

5.3 Risk Management: Set stop-loss orders to limit potential losses and have a clear exit strategy in place.

5.4 Stay Informed: Continuously monitor your portfolio and stay updated with market news and events that may impact your investments.

Section 6: Real-World Success Stories

Highlight real-world success stories of investors or funds that have effectively employed momentum investing to achieve remarkable returns.

6.1 Notable Investors: Explore the strategies and success stories of well-known investors who have embraced momentum investing.

6.2 Historical Data: Provide examples of stocks or market segments that have exhibited strong momentum and the resulting outcomes.

Section 7: Conclusion

In conclusion, momentum investing is a compelling strategy for those seeking to profit from stocks on the rise. By understanding the principles, identifying strong momentum stocks, managing risks, and staying informed, investors can effectively leverage this strategy to potentially achieve significant returns. However, it’s crucial to approach momentum investing with caution, as it comes with its own set of risks. As with any investment strategy, careful research and discipline are essential for success. Start exploring momentum investing today and tap into the power of rising stocks to potentially enhance your portfolio’s performance.